Running an online store is exciting but money matters a lot while managing your business.

For Shopify merchants, transaction fees are unavoidable costs of doing business. If you don’t manage it carefully then you can lose a lot of profits and have less money to grow your store.

Small businesses operate on tight budgets which means that every extra dollar spent on transaction fees could have gone toward marketing, inventory, or improving customer experience. That’s why understanding and managing these fees is crucial for staying profitable.

In this blog, our developers will break down Shopify transaction fees explained in simple terms. You’ll also learn practical tips to reduce Shopify payment processing costs and understand how to choose the best Shopify plan for your business.

Whether you’re just starting to optimize your store’s expenses then this blog will help you keep more of your hard-earned profits.

What You Need to Know: Shopify Transaction Fees Explained

When you set up a Shopify store, understanding how fees work is necessary to manage costs. Shopify’s pricing structure includes three main components:

- 1. Subscription Fees : These are the monthly charges for using Shopify’s platform. They depend on the plan you choose (Basic, Shopify, Advanced, or Plus).

- 2. Transaction Fees : Shopify charges a fee for each sale you make if you’re not using Shopify Payments. This fee is a percentage of the sale and can quickly add up if you depend on third-party payment gateways.

- 3. Payment Processing Fees : These apply to all transactions and are charged based on the payment method used like credit cards and digital wallets.

Shopify Payments vs. Third-Party Payment Gateways

Shopify Payments is Shopify’s in-house payment processor. When you use it, you avoid additional transaction fees that are usually charged with third-party payment gateways like PayPal and Stripe. It can reduce your costs. However, payment processing fees still apply that change depending upon your plan and the region you operate in.

Example: How Fees Add Up on Different Plans

Suppose you’re selling $10,000 worth of products each month. Here’s how transaction fees could change based on your plan:

- Basic Shopify Plan : The transaction fee is 2%, so you’ll pay $200/month if you use a third-party gateway.

- Shopify Plan : The transaction fee is 1%, so your cost drops to $100/month.

- Advanced Shopify Plan : The transaction fee is 0.6%, so you’ll pay just $50/month.

Now, if you switch to Shopify Payments, you can avoid these additional transaction fees entirely and only pay the standard payment processing fees.

By choosing the right plan and payment gateway, you can minimize fees and keep more of your revenue.

That’s why it’s important to evaluate your options and align them with your business needs.

We will explore practical strategies to reduce Shopify payment processing costs and help you choose the best Shopify plan for your store.

What is the impact of Shopify Plans on Transaction Fees?

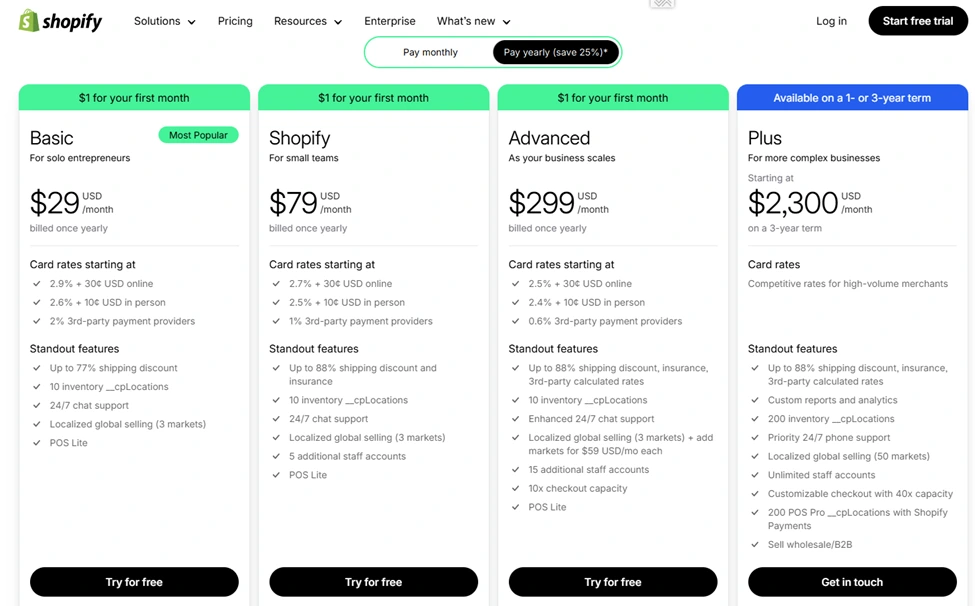

Choosing the right Shopify plan isn’t just about getting access to advanced features but it also plays a big role in how much you pay in transaction fees. Shopify offers four main plans: Basic Shopify, Shopify, Advanced Shopify, and Shopify Plus. Let’s break them down to see how they affect your costs.

Overview of Shopify Plans

- 1. Basic Shopify : Ideal for small businesses just starting out. It comes with essential tools but has the highest transaction fees for third-party payment gateways (2%).

- 2. Shopify Plan : A great middle-ground for growing businesses. It offers more features than Basic Shopify and reduces transaction fees to 1%.

- 3. Advanced Shopify : Designed for high-volume stores. It includes advanced reporting tools and the lowest transaction fees for third-party gateways at 0.6%.

- 4. Shopify Plus : This enterprise-level plan is for large businesses. It offers custom pricing and premium support, making it ideal for scaling your operations.

Transaction Fees and Features

If you’re not using Shopify Payments, Shopify charges transaction fees for each sale based on your plan. For example:

- Basic Plan : 2% per transaction.

- Shopify Plan : 1% per transaction.

- Advanced Plan : 0.6% per transaction.

These fees can impact your profit, especially if you’re processing a large number of sales.

How to Choose the Best Shopify Plan?

To choose the best Shopify plan, you need to consider the size of your business and your monthly sales volume:

- If you are making fewer sales, the Basic Shopify plan is a cost-effective option.

- For growing stores with consistent sales, the Shopify Plan strikes a balance between features and lower transaction fees.

- High-volume businesses can save the most with Advanced Shopify, thanks to its lower transaction fees and advanced tools.

- Large enterprises should opt for Shopify Plus for its scalability and custom pricing options.

By picking the right plan for your business size, you can reduce Shopify transaction fees and keep more of your hard-earned revenue.

Your payment gateway choice also matters a lot because using Shopify Payments can help you eliminate extra transaction costs altogether.

Explore some actionable tips to reduce Shopify payment processing costs and make your store even more profitable.

Source: Shopify

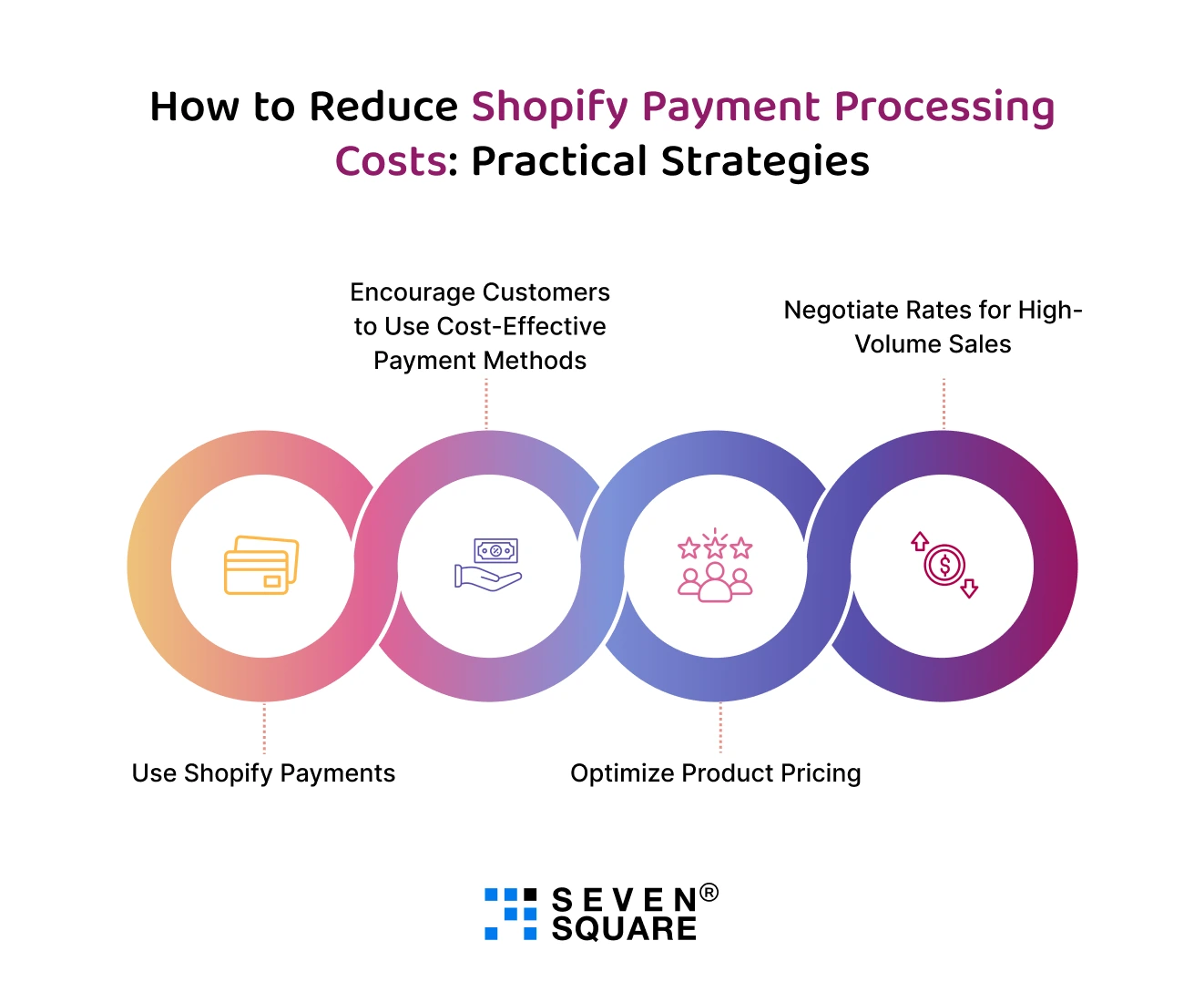

How to Reduce Shopify Payment Processing Costs: Practical Strategies

Transaction fees can eat into your profits, but the good news is that there are several ways to reduce Shopify payment processing costs.

You can use the right tools and strategies to minimize fees and keep more of your revenue. Here are some practical tips to help you save money:

1. Use Shopify Payments:

- One of the easiest ways to eliminate additional transaction fees is by using Shopify Payments, Shopify’s built-in payment processor.

- Unlike third-party gateways, Shopify Payments doesn’t charge extra transaction fees, so you only pay the standard credit card processing rates.

- This can save you a lot, especially if you’re making frequent sales.

2. Encourage Customers to Use Cost-Effective Payment Methods

- Some payment methods come with lower processing fees than others.

- For example, debit cards often cost less to process than credit cards.

- You can encourage customers to use these cost-effective options by offering small incentives like discounts and free shipping for specific payment methods.

3. Optimize Product Pricing:

- When you are setting your product prices it is important to look for transaction and payment processing fees.

- Add a small buffer to your prices to cover these costs without making your products too expensive for customers.

- It will help you to absorb the fees without affecting your profit margins.

4. Negotiate Rates for High-Volume Sales:

- If you’re on the Advanced Shopify or Shopify Plus plan and process a high volume of sales, you may be able to negotiate lower payment processing rates with Shopify.

- This is especially useful for large businesses, as even a small reduction in rates can lead to significant savings over time.

By following these strategies, you can effectively reduce Shopify payment processing costs and make your store more profitable.

Whether you’re just starting or scaling your business, managing fees is key to maximizing your profit.

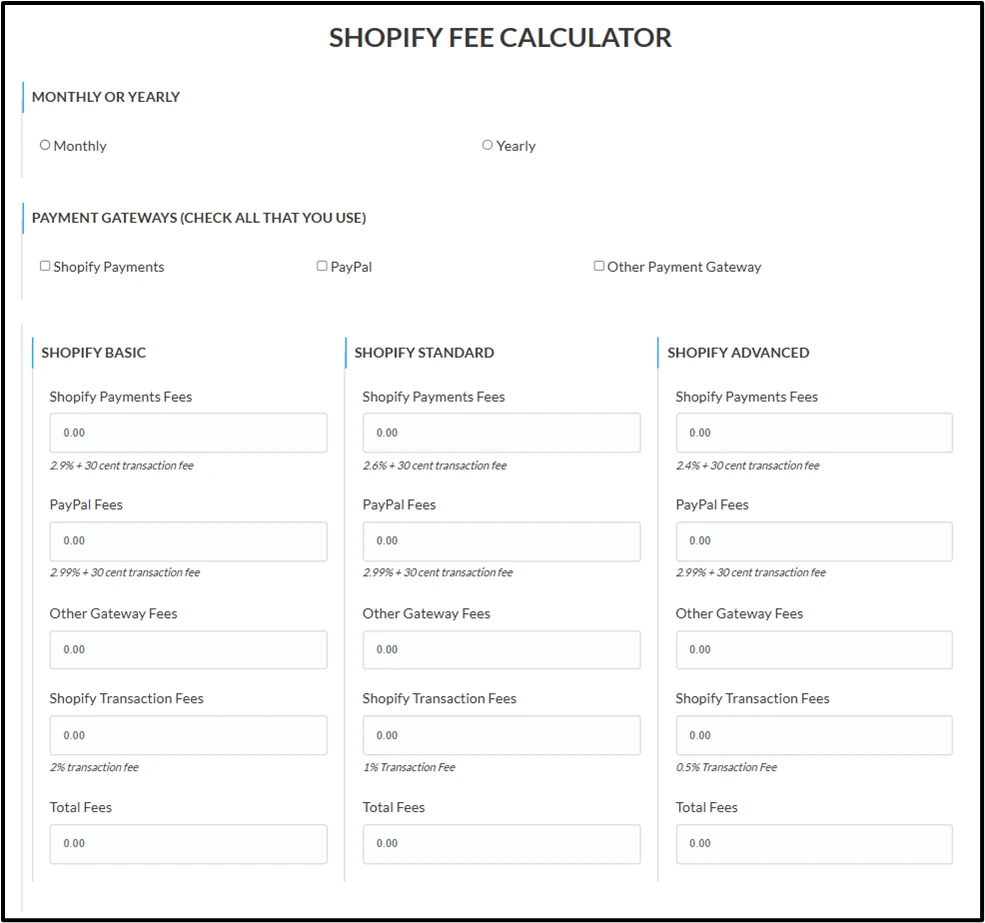

Which Tools and Resources We Suggest to Simplify Shopify Fee Management?

We understand that managing Shopify transaction fees can be complicated. That’s why while building the Shopify store we suggest the best tools and resources so that you can keep track of costs, optimize your payments, and make smarter decisions for your store.

1. Shopify Fee Calculators

- Our Shopify store developer suggests some of the best fee calculators so that you can estimate your costs for each sale, including subscription fees, transaction fees, and payment processing charges.

- They’re especially useful for comparing different Shopify plans and figuring out how much you can save by switching.

Popular Shopify Fee Calculators:

- Shopify Calculator by EcommerceGold : A simple tool to calculate fees for different plans.

- Shopify Payments Fee Calculator : A specialized calculator to estimate costs based on your sales volume and payment methods.

2. Plugins to Optimize Payments and Reduce Costs

Shopify’s App Store offers plugins that can help you reduce transaction fees and simplify payments.

Hire Shopify developers from us who will suggest these apps and plugins to automate tasks, improve customer checkout experiences, and cut down on unnecessary costs.

Top Plugins to Try:

- Currency Converter Plus: Automatically converts prices to local currencies, reducing currency conversion fees for customers.

- Bold Cashier: A better checkout solution that can optimize payment gateways for lower fees.

- Managed Markets: A Shopify-native tool for handling international sales and minimizing extra fees.

3. Choose the Best Payment Gateway

Our best Shopify developers know that choosing the right payment gateway is key to minimizing costs.

There are many options available, each with its fees and features.

We have a team of Shopify Plus developers who created this blog so that you can compare payment gateways based on transaction fees, processing times, and compatibility with Shopify.

A resource to Explore:

- Shopify’s official guide to Payment Gateways.

- How to choose a payment provider || Shopify Help Center

We have the best team of Shopify Front End Developers who maximize these resources so that it becomes so much easier for you to manage Shopify transaction fees, so you can focus on stock of the products.

What are the Hidden Costs that You Need to Watch Out for?

Shopify transaction fees and payment processing costs are straightforward but hidden costs can affect your profitability. Here are some common hidden expenses to keep an eye on and tips to avoid them.

1. Chargebacks: The Silent Profit Killer

Chargebacks happen when a customer disputes a charge, and the funds are reversed to their account.

Each chargeback comes with a fee and it can add up over time. Frequent chargebacks not only cost money but can also hurt your store’s reputation.

How to Minimize Chargebacks:

- Communicate your refund and return policies to customers.

- Provide accurate product descriptions and images to avoid misunderstandings.

- Use tracking numbers for shipments to prove delivery in case of disputes.

2. Currency Conversion and International Transaction Fees

If you sell to customers in other countries then you may face additional costs for currency conversion and international transactions.

Shopify Payments charges a fee for converting payments into your store’s currency, which can impact your profit.

How to Reduce These Costs:

- Price your products in local currencies to avoid conversion fees for customers.

- Use Shopify Markets to manage pricing and payments for international sales efficiently.

- Consider using a multi-currency payment gateway that offers competitive exchange rates.

3. Unexpected Expenses and How to Avoid Them

Small and unexpected fees can quickly add up if you’re not careful. These might include:

- App Subscription Costs : Extra tools and features from the Shopify App Store can improve your store but may come with monthly fees.

- Theme Customization Costs : Premium themes or hiring a developer for customizations can increase your expenses.

- Third-Party Gateway Fees : Using a gateway other than Shopify Payments may result in extra charges.

Tips to Minimize Surprises

- Regularly review your Shopify billing statement to identify hidden fees.

- Use free or budget-friendly apps and themes whenever possible.

- Stick to Shopify Payments to avoid third-party gateway fees.

By understanding these hidden costs and taking proactive steps to minimize them, you can keep your store’s expenses under control and maintain profitability.

FAQs

- Shopify transaction fees are calculated as a percentage of each sale’s total amount without shipping.

- For example, on the Basic Shopify Plan if you use a third-party gateway incurs a 2% transaction fee.

- However, if you use Shopify Payments, you avoid these fees and only pay credit card processing charges.

- Shopify Payments is Shopify’s built-in payment system that eliminates additional transaction fees.

- Third-party gateways are like PayPal and Stripe which come with extra fees including both Shopify’s transaction fees and the gateway’s processing charges.

- The Shopify Plus Plan has the lowest credit card rates while the Advanced Shopify Plan offers lower rates than Basic and Shopify plans.

- If you use Shopify Payments then there are no additional transaction fees across all plans.

- Yes, if you use Shopify Payments as your payment processor then you don’t have to pay any additional transaction fees. You will only need to cover the standard credit card processing fees.

- You can use a Shopify fee calculator to estimate costs. These tools take into account your sales volume, Shopify plan, and whether you use Shopify Payments and a third-party gateway.