Nowadays it is a difficult task to choose the right payment gateway for your business.

Payment Gateways are mainly used in various eCommerce platforms, mobile applications, and even subscription-based services.

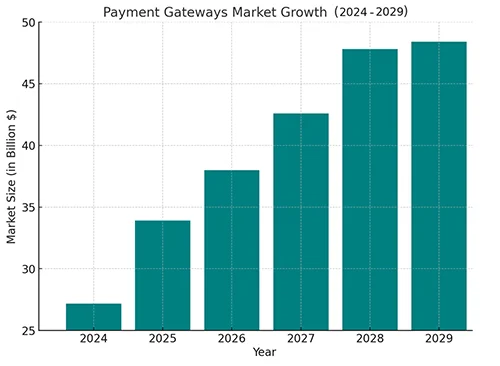

It can be surprising but the payment gateways market is expected to grow at the rate of CAGR 12.6% from 26.7$ billion to 48.4$ billion in 2029.

If you want to expand your eCommerce store then you need to select some of the best payment gateways.

Payment gateways are necessary for secure online transactions and accept payments through methods like credit/debit cards, digital wallets, and bank transfers.

We have created a list of the top 7 payment gateways for websites and apps including their fees, features, etc.

How Payment Gateways Work?

Let’s understand how payment gateways work by using the example of Alex who loves to buy the latest gadgets. So Alex has to go through the steps that are given below:

- Customer Initiates Payment : Once Alex finds a Smart Watch online he adds it to his cart and clicks on the “Checkout” option. Then he enters his credit card details and hits “Pay Now”. Now the transaction through the payment gateway starts.

- Data Encryption and Transmission : The payment gateway immediately encrypts the details of Alex. This encryption ensures that his sensitive information like his credit card number is protected and then data will be sent for authorization.

- Payment Authorization : Now the encrypted details are sent to Alex’s bank or credit card network. The bank quickly checks the information and verifies that he has enough funds to buy the Smart Watch.

- Transaction Approval or Decline : Within seconds, the bank decides whether to approve or decline the transaction. If everything checks out like available funds and account status then Alex’s purchase will be approved.

- Funds Transfer : After the approval, Alex’s bank transfers the payment amount to the merchant’s bank. The funds are then deposited into the merchant’s account to complete the financial transaction.

- Merchant Notification : As the payment is done, the payment gateway sends a notification to the merchant’s website. The merchant receives all the transaction details so they can prepare Alex’s order for shipping.

- Entry Logs : Every step of this process, from Alex entering his payment details to transferred funds, is carefully logged. These logs are important for security and auditing.

Types of Payment Gateways

There are different types of payment gateways available in the market. Here you can explore four times of payment gateways:

1. Hosted Gateways

- Hosted gateways redirect the customers to the payment service provider’s platform.

- It is easy to implement and the payment provider will handle sensitive data.

- That can spoil the user experience as customers will be taken from your site during checkout.

2. Self-Hosted Gateways

- Self-hosted gateways allow businesses to collect payment details directly on their website.

- This option gives businesses better control over the user experience and branding.

- They have to follow the security standards like PCI DSS to handle customer data directly.

3. API-Hosted Gateways

- API-hosted gateways can be integrated quickly because they allow you to customize the payment gateway in your website and app

- With API you can have full control over the transaction process. You need to have some technical expertise as you have to follow security protocols.

4. Local Bank Integration

- During local bank integration, you have to link your website with the local bank’s payment processing system.

- It is perfect for businesses that are focusing on specific regions and want to build trust among the customers.

Top 7 Payment Gateways For Websites

Choosing the right payment gateway for your website is important for the success of your website and application. Now let’s discuss the top 7 payment gateway services that can be used by startups and large-scale enterprises in their websites and apps.

1. Stripe

Stripe is a popular payment gateway that is used because of its developer-friendly APIs. It can be a perfect payment solution for complex businesses that need to handle a large number of transactions.

Stripe is mostly used in the industries like eCommerce, SaaS, Marketplaces, On-demand apps, and many more. It is mainly used in the United States but has a presence in Europe, Australia, and Asia. One of the main advantages of Stripe is its currency and payment method support.

It is used by some of the most popular companies like Accenture, Alaska Airlines, Amazon, Atlassian, AWS, Bloomberg, Decathlon, and many more.

Key Features:

- Global Payments : With Stripe you can accept payments in more than 135 countries by using payment methods like credit cards, ACH transfers, etc.

- Subscription Management : It comes with tools to manage continuous billing and subscriptions.

- Developer-Friendly API : Developers can customize Stripe’s API to integrate it into websites and applications.

- Customizable Checkout : You can use it to provide personalized checkout according to your business.

- Security : It comes with PCI DSS Level 1 Certification that helps in fraud detection and data encryption.

Pricing:

- Standard : 2.9% + 30 ¢ per successful charge for US businesses with domestic cards.

- Custom : Get a custom package for businesses with a large number of transactions.

- Extra Costs : 1% fee for using international cards and currency conversions.

2. PayPal

PayPal is one of the most well-known payment gateways all over the world. It was founded in 1998 and is used by users and businesses because of its ease of usefulness and security.

PayPal is the first choice for startups, medium-sized businesses, and even freelancers. It is used in industries like eCommerce, digital goods, and service-based industries.

It has a large user base in the United States and Europe. PayPal is also popular in the UK, Canada, and Australia which makes it the best option for international transactions.

PayPal is integrated into some popular brands like Puma, Airbnb, American Airlines, Calvin Klein, Netflix, Disney Store, Aeropost, HP, Zara, and many more.

Key Features:

- Convenience : It is easy to set up and smooth integration with most of the eCommerce websites.

- Worldwide Reach : PayPal is supported in more than 200 countries and it accepts around 25 currencies.

- Buyer Protection : With PayPal’s buyer protection program it minimizes the risk of fraud.

- Payment Options : The users can get multiple payment options like credit/debit cards, bank transfers, and PayPal balances.

Pricing:

- The pricing of PayPal is a bit complex as it involves many factors so you can see the pricing based on your business here.

3. Razorpay

Razorpay is a top payment gateway that was founded in 2014. It is mainly used to provide a smooth, secure, and efficient way for businesses in India. Razorpay provides support for various payment methods and that’s why it is one of the most preferred choices for Indian businesses.

It is used in different types of Indian startups, SMEs, and large businesses like SaaS, eCommerce, On-demand services, and many more.

Razorpay is used in India as it understands the Indian market and provides support for payment methods like UPI.

It is integrated into popular businesses like Croma Electronics, Saregama, Cars24, MyGlamm, HealthifyMe, Porter, and many more.

Key Features:

- Payment Methods : It provides support for payment methods like credit/debit cards, UPI, net banking, wallet, and EMI.

- Quick Settlements : The businesses can get funds quickly with minimum settlement time.

- RazorpayX : It provides information like current accounts, payouts, automated invoicing, and many more.

- Advanced Dashboard : In Razorpay you can get real-time data insights, analytics, and financial reports for better business management.

Pricing:

- Standard : 2% per transaction through Indian credit/debit cards, net banking, and UPI payments.

- International Charges : 3% per transaction for payments through international cards.

4. CCAvenue

CCAvenue is one of the leading payment gateways for websites and India’s almost 85% of eCommerce businesses use it. It was established in 2001 and is known for its wide network with strong security functionalities.

It is beneficial for both domestic and international customers. CCAvenue is used in industries like eCommerce, travel, hospitality, retail, and education.

CCAvenue is mostly used in India but some businesses in UAE and the Middle East also use it.

It is integrated into well-known brands like MakeMyTrip, AirAsia, GoAir, Myntra, Peta India, Sikkim Manipal University, Symbiosis, and many more.

Key Features:

- Payment Options : CCAvenue provides support for payment options like credit/debit cards, UPI, net banking, digital wallets, EMI, and many more.

- Currency Support : With this payment gateway businesses can accept payment in 27 popular currencies for international users.

- Smart Routing : It ensures the success of transactions by selecting the best payment option.

Pricing:

- Standard : 2% per transaction through Indian credit/debit cards, net banking, wallets, EMI, and UPI payments.

- International Charges : 4.99% per transaction for payments through international debit/credit cards like MasterCard & Visa.

5. PayU

PayU is one of the emerging payment gateways that was founded in 2002 that allows businesses to accept and process payments within web and mobile applications.

It is one of the best payment gateways that encourages local payment methods with user-friendly design and smooth transactions for various industries.

PayU is perfect for businesses in eCommerce, travel, education, and digital services who have a constantly growing user base.

It is used in India, Latin America, and Africa. PayU is integrated into popular businesses like Airbnb, Netflix, BookMyShow, Wix, BigCommerce, Zoho, WooCommerce, WordPress, and many more.

Key Features:

- Subscription Billing : With PayU, businesses can manage recurring payments easily which makes it the perfect choice for subscription-based services.

- CFraud Prevention : It uses advanced fraud detection tools and real-time risk monitoring for secure transactions.

- Quick Integration : One of the key features of PayU is its quick integration with major eCommerce platforms so that you can start accepting payments within minutes.

Pricing:

- Standard : 2% to 3% per transaction depending upon payment method and region.

6. Apple Pay

Apple Pay is one of the most commonly used payment gateways with mobile payment & digital wallet services that was launched in 2014. It allows users to make payments in iOS apps and the websites they are using on their Apple devices.

Apply Pay uses Apple’s huge ecosystem of iPhones, iPads, Apple Watches, and Macs to provide a fast, secure, and smooth payment experience.

It is highly useful for industries like eCommerce, retail, service, and hospitality to provide a quick payment experience. Apple Pay is widely used in the United States but slowly it is getting popular in the UK, Canada, Australia, Europe, and even Asia.

It is integrated into famous businesses like Best Buy, Delta, DoorDash, Etsy, Instacart, Lyft, Pinterest, Starbucks, Uber, and many more.

Key Features:

- Contactless Payments : It allows users to make payments using their iPhone or Apple Watch simply using the contactless payment option.

- In-App and Online Purchases : Simplify the payment processes within apps and websites so that users don’t have to enter card details.

- Integration with Apple Devices : Quickly integrate into Apple’s devices to improve the user experience with Face ID and Touch ID authentication.

Pricing:

- It doesn’t charge any additional fees other than the standard credit card processing fees.

7. Authorize.Net

Authorize.Net is a part of Visa and it is one of the well-established payment gateways for websites that provide dependable services for online payments. It was launched in 1996 and since then it has become a first choice for all types of businesses.

Authorize.Net is useful for startups and medium-sized businesses in industries like retail, eCommerce, healthcare, and many more.

It is mainly used in the United States but is also popular in Canada, Australia, the UK, and many more.

Authorize.Net is integrated into popular firms like Samsclub, Jotform, Unity, Cybersource, Fromstack, Pinc Solutions, Cvent, and many more.

Key Features:

- Payment Options : Get support for multiple payment methods like credit/debit cards, eChecks, and other digital payment methods.

- Virtual Terminal : Businesses can easily start the process of payments through phone or email for remote transactions.

- Developer Tools : It offers APIs and SDKs for smooth integration with eCommerce platforms and custom applications.

Pricing:

- All-in-One Plan : $25 Monthly gateway feeds and 2.9% + 30 ¢ are the processing rates per transaction.

- Custom Plans are also available.

We have integrated these Payment Gateways into Websites and Mobile Apps

At Seven Square we have a team of experienced developers who can integrate all of these top 7 payment gateways into your website or application according to your target audience and requirements.

We have delivered solutions for various regions and here are the examples:

| Project Name | What We Did and Which Payment Gateway We Integrated | Targeted Region or Country |

| The Cowhand Market |

|

Canada |

| MeditationWise |

|

USA |

| SelfStudy-UPSC Learning App |

|

India |

| MHEA |

|

India |

| Mad House Party |

|

India |

| Selfa |

|

USA |

Which Factors You need to Consider Before Integrating a Payment Gateway?

Before integrating a payment gateway into your website or application you need to think about factors like security standards (PCI DSS), transaction fees, payment methods, and many more.

Here are some key points that you need to consider while you are integrating the best payment gateway for your platform:

1. Business Requirements

- It is important to select a payment gateway that is up to your business requirements.

- Look out for the key points like number of users, target audience market, and customer preferences to ensure a smooth and scalable payment process.

2. Security

- As the business owner you should ensure that the payment gateway provides various encryption and fraud prevention tools.

- Try to get the features like tokenization and 3D security to minimize the risk of data breaching.

3. Payment Types and Supported Currencies

- Choose a payment gateway that supports various payment types like credit/debit cards, digital wallets, and many more.

- It should support multiple currencies globally to simplify the conversion rates.

4. Payment Gateway Integration Costs

- Ensure to integrate a payment gateway in your business that has minimum setup fees, transaction fees, maintenance charges, etc.

- Always avoid the payment gateways that come with hidden costs because they can affect your business badly.

Want to Integrate a Payment Gateway in your Website? Contact Us Now!

FAQs

Stripe, PayPal, Razorpay, PayU, and CCAvenue are some of the best payment gateways in 2024. These platforms can be integrated into different types of eCommerce stores that need to handle more customers without crashing.

- Security : They ensure that customers’ data is secure by encrypting their debit/credit card details.

- Quick Transactions : Various payment gateways help to simplify the transactions and they can be completed quickly.

- Payment Options : They provide multiple payment options for the convenience of the customers.

There are many benefits of using payment gateways for eCommerce businesses and some are mentioned below:

Yes, it is possible to integrate multiple payment gateways into your website or application. As the business owner you want to provide more options to your customers so they can easily make payments according to their convenience.

Razorpay is one of the best payment gateways for Indian businesses but you can even use alternatives like PayU, CCAvenue, and PayPal.

Stripe and PayPal are some of the best API payment gateways that you should integrate into your eCommerce store, website, or application.

PayPal is one of the largest and most used online payment platforms that is used by more than 30 million merchants.

Customers prefer to use payment methods like credit/debit cards, digital wallets, buy now & pay later, and bank transfers while purchasing anything from a website.